The cost of bad data is a long-standing crisis. In 2020, Gartner reported that poor data quality costs organizations an average of $12.9 million annually. Over half a decade later, the core issue remains: most companies still treat their CRM as a static data-collection exercise rather than the revenue intelligence system it’s meant to be.

Over the years, we’ve analyzed and organized hundreds of cluttered CRMs across industries. The pattern is consistent: companies enrich CRM data, celebrate achieving 90%+ completeness, and then… nothing changes. This happens because most business data enrichment efforts stop at ‘clean’ when they should be aiming for ‘context.’

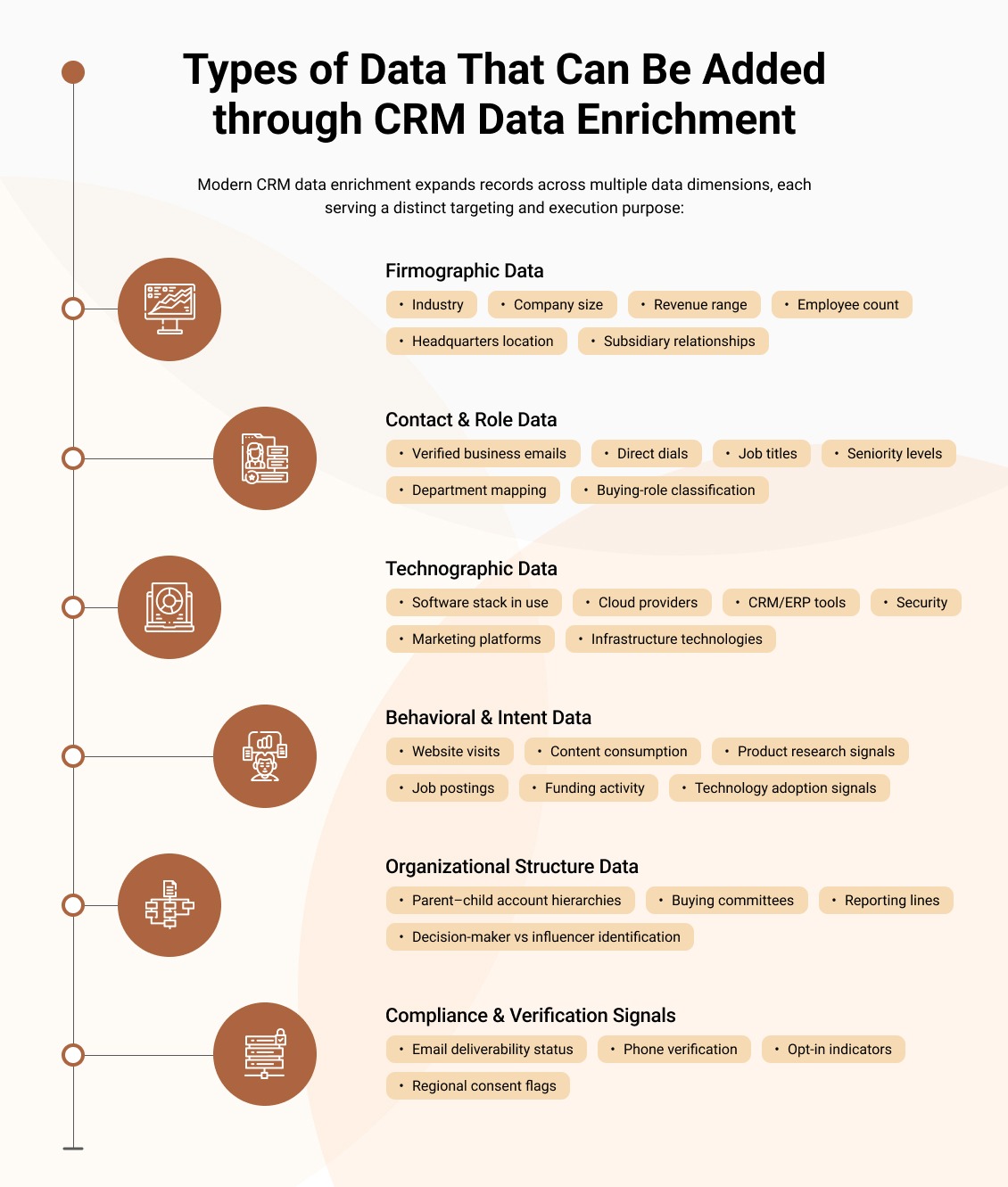

True CRM data enrichment is the difference between a sales team that “guesses” and one that “knows.” It’s the process of layering external insights—like technographics, trends, firmographics, social media behavior, and intent signals—onto your existing records to pinpoint exactly who is ready to buy. Is that something your CRM data enrichment workflow takes care of?

If not, here is how to bridge the gap between business data enrichment & B2B sales intelligence and close more deals faster.

The CRM Data Enrichment-to-Execution Gap (Why Most Teams Fail)

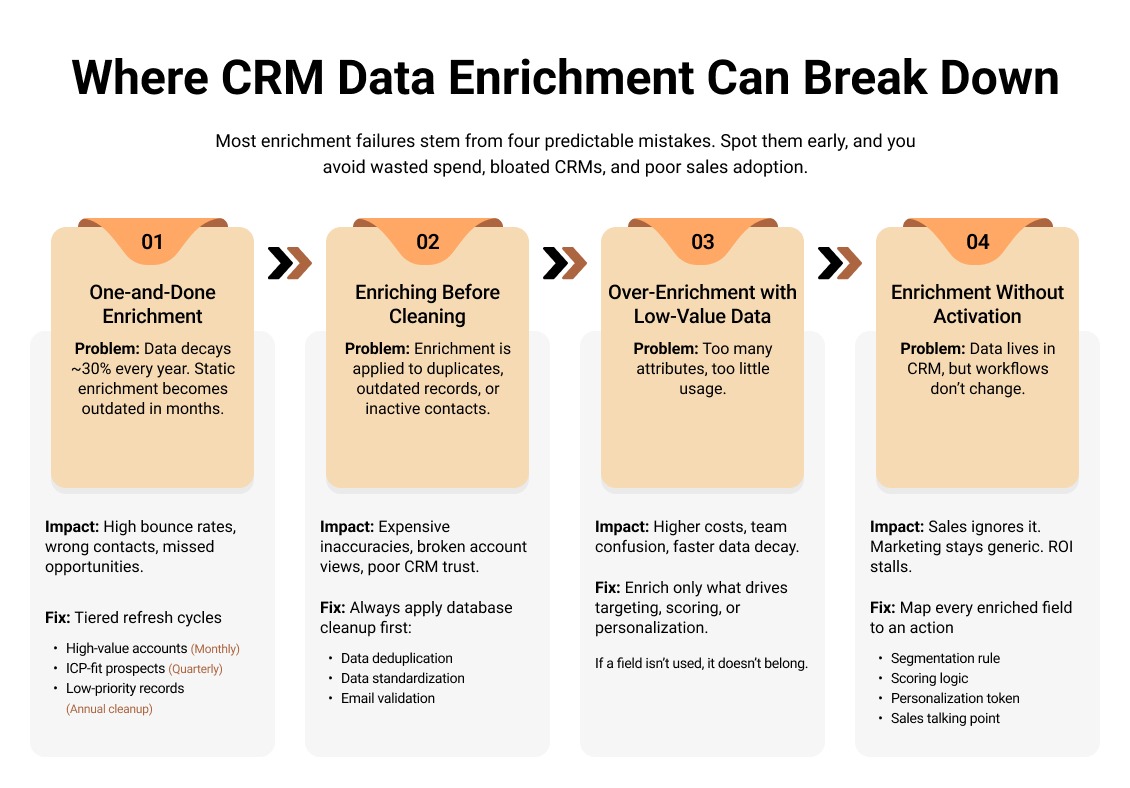

Most companies approach CRM data enrichment as a data quality project. They focus on filling empty fields, standardizing formats, and achieving “complete” records, but they only occasionally enrich CRM data and do so only partially. They focus on CRM data cleansing and completion, but don’t link this process to their broader sales and marketing goals.

Then they wonder why their outreach ROI doesn’t improve!

The fundamental problem is a language barrier. Data teams measure success by record completeness (e.g., “90% of profiles have phone numbers”). Revenue teams measure success by pipeline velocity and conversion rates (e.g., “How fast can we close this?” or “50% leads converted”). These metrics rarely align because the entire enrichment effort is focused on data hygiene, not commercial intelligence. Companies that properly execute CRM enrichment strategies see measurable improvements—but only when they connect enriched CRM data directly to targeting and engagement strategies.

The required mindset shift is simple: Stop thinking about “complete records” and start thinking about “sales-ready intelligence.” Every enriched CRM data point should answer a specific targeting question:

- ICP Fit: Does this account fit our ICP (Ideal Customer Profile)?

- Technology Readiness: What’s their current tech stack?

- Buying Committee: Who are the decision-makers you need to influence?

- Intent Triggers: Which recent actions (hiring, funding, web activity) indicate purchase intent?

Once you understand the source of the execution gap, the next step is to implement CRM data enrichment to support sales and marketing goals directly.

How to Enrich CRM Data – Start by Mapping Targeting Goals to Data Needs

Successful sales and marketing teams work backwards. They don’t enrich data randomly—they map B2B data enrichment priorities directly to their audience targeting needs as well as go-to-market strategy.

Here’s a similar recommended framework for setting your enrichment priority:

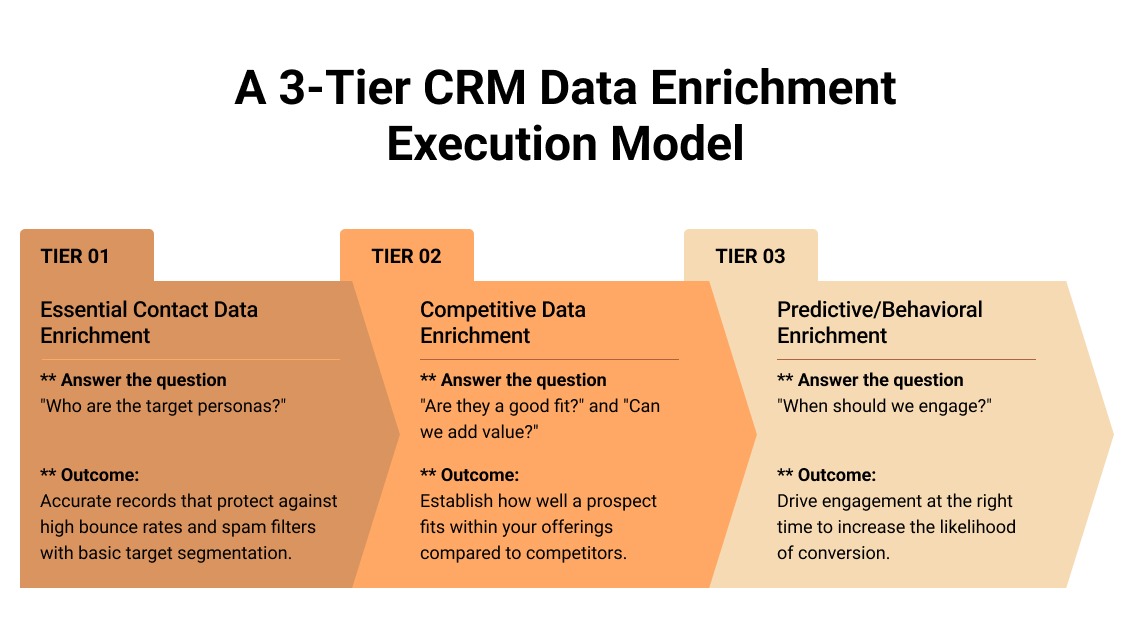

A 3-Tier CRM Data Enrichment Execution Model

Tier 1: Essential Contact Data Enrichment

Purpose: Define who your target buyers are and ensure you can reliably reach them.

Build a standard ICP-focused target lead list by collecting clean, standardized contact and company data (name, job role, seniority level, company size, industry, location) and verified emails & direct dials that protect deliverability.

Benefits to Businesses:

- Reliable audience segmentation

- Lower bounce rates and spam risk

- A CRM that is operationally usable at scale

Tier 2: Competitive Data Enrichment

Purpose: Establish how well each prospect fits your offering and where you can deliver differentiated value.

By collecting data related to the technographic stack, software usage, employee growth, hiring signals, funding activity, and organizational structure, you get clear visibility into the target organization’s/team’s solution alignment and context for differentiated outreach, which helps you prioritize accounts based on strategic relevance and reach out to them through more value-specific messaging.

Benefits to Business:

- Higher-quality targeting decisions

- Stronger positioning in sales conversations

- Improved conversion from qualified accounts

Tier 3: Predictive & Behavioral Data Enrichment

Purpose: Determine when to engage prospects based on real buying signals to maximize conversion impact.

Using enriched data on intent and behavioral signals, job changes and leadership movements, and business or market trigger events, you can identify real-time engagement readiness (like a prospect browsing specific product pages on your website, showing interest in related content, or interacting with your emails). This enables you to dynamically prioritize high-intent accounts (that are actively showing interest) and hence, have a higher conversion potential.

Deliverables:

- Real-time engagement readiness signals

- Trigger-based outreach opportunities

- Dynamic prioritization of high-intent accounts

Data Enriched:

- Intent and behavioral signals

- Job changes and leadership movements

- Business and market trigger events

Benefits to Business:

- Shorter sales cycles

- Higher engagement rates

- Increased win probability through timely outreach

Apply This Tiered B2B Data Enrichment Solution Strategically

The mistake most teams make is trying to achieve Tier 3 sophistication across their entire database. This is expensive, time-consuming, and largely unnecessary. Instead, apply the recommended tiered approach sequentially, or based on your sales and marketing goals, to manage costs and maximize impact:

- Tier 1: Apply to your entire database (enables basic operations and hygiene).

- Tier 2: Apply only to accounts matching your ICP criteria (enables targeted campaigns).

- Tier 3: Apply only to high-value target accounts (enables precision ABM).

This creates a decision matrix: Which enrichment investments will have the highest impact on your specific revenue goals?

For instance:

- If you are running enterprise ABM campaigns (targeting a small list of large, high-value accounts), Tier 2 and Tier 3 are critical.

- If you are focused on high-volume SMB outreach (targeting small and midsize businesses), a Tier 1 data enrichment strategy is a practical choice.

Evaluate CRM Data Enrichment Sources Carefully

Many organizations using Zoho CRM, Salesforce, or HubSpot, etc., assume their CRM’s built-in data enrichment tools are “good enough. While platform-native enrichment tools offer convenience and broad functionality, they often lack the depth required for high-intent targeting. They pull data from broad, static pools of information that may not be refreshed frequently enough to facilitate high-stakes outreach.

To address this, some businesses use AI-powered data enrichment tools (e.g., Clay, Apollo.io, ZoomInfo) to scrape the web in real time for news or social activity. However, these teams often struggle with “data hallucinations” or irrelevant data points that require manual oversight. Ultimately, this forces your team to look for the right data elsewhere and get involved in data validation for CRM data enrichment (or hire B2B data appending service providers for the same).

If you don’t want that struggle but need to ensure CRM data integrity, you must evaluate your data sources based on these three pillars:

Data Freshness & DecayNative tools often update records on a set schedule (e.g., every 30-60 days). If you are chasing fast-moving tech startups or companies with high turnover, you need real-time data verification to prevent high bounce rates. |

The “Niche” FactorStandard CRM plugins excel at firmographics (location, employee count). However, if your lead generation depends on technographics (e.g., which AWS version they use) or intent (e.g., what they are searching for on G2), you need deeper “last-mile” data. |

Record Verification vs. EstimationMany broad data sources “estimate” email addresses or direct dials based on patterns. To protect your CRM data integrity, you need a source that uses multi-step data verification, so your lead generation efforts aren’t wasted on dead-end records or “catch-all” inboxes that kill your domain’s deliverability. |

|

The Problem-First Audit (Avoid “Vanity Enrichment”)

Avoiding “vanity enrichment” is crucial. Do not pay for exotic data points that sound impressive but drive zero targeting improvements. If an enriched attribute doesn’t help you segment, prioritize, or personalize leads, it is a wasted investment.

Here’s a practical tip from our experience with contact data enrichment: Audit your current audience-targeting challenges before enriching any dataset. Let the problem faced by sales & marketing representatives in acquiring verified leads or converting them define the enrichment strategy, not the other way around.

- Are your sales reps wasting time on unqualified leads? You need better fit scoring (Tier 2).

- Are you reaching out at the wrong time? You need intent signals (Tier 3).

- Are your emails getting delivered and ignored? You have valid contact info, but you lack the personalized “hooks” and recent news insights needed for relevance (Tier 2).

- Are deals stalling because you’re stuck with “champions” instead of “deciders”? You need to enrich data for the full buying committee and persona hierarchy, i.e., better contact discovery (Tier 2).

- Are your outreach efforts being blocked by spam filters? You have a data decay problem and need real-time email verification (Tier 1).

- Are your reps using a “one-size-fits-all” pitch? You need technographic enrichment to understand their current environment and offer a displacement solution (Tier 2).

Once your enrichment priorities are mapped, your data collection sources are fixed, and you are confident about which data to collect, the real leverage begins—using enriched attributes to build precise, high-intent audiences.

Building High-Intent Target Audiences from Enriched CRM Data

Enriching CRM data only creates potential for focused lead generation. Translating that data into high-intent audiences is where results come from. Most teams stop at basic filters—industry, size, geography. But high-performing teams go further by layering enriched attributes to model real buying scenarios rather than generic segments.

Here are some examples of how you can do it systematically:

1. Prioritize the Right Accounts Using Firmographic Attributes

When observed in silos, data points can lead to severely misplaced expectations. For example, a 500-employee company growing at 40% YoY is a very different target from a 500-employee firm that has laid off 25% of its workforce in the last three months. In this case, company size alone can’t signal opportunity. Growth and momentum must be taken into account.

Use enriched firmographic combinations to score and prioritize accounts:

- Company size + revenue range → ICP fit

- Employee growth rate → Expansion signal

- Recent funding activity → Budget availability

- Geographic footprint → Operational fit

This naturally simplifies priorities for your sales and marketing team.

- Priority 1: These are your highest-value targets. They match your Ideal Customer Profile (ICP) and show “buying signals” like recent funding or rapid hiring. They should receive your most personalized, high-intensity sales efforts.

- Priority 2: These are stable prospects that fit your target criteria but lack immediate “trigger events.” These accounts should be handled using standard sales outreach to build relationships over time.

- Priority 3: these are leads that only partially match your target profile. Because their potential value is lower, they should be managed through automated “nurture” marketing (newsletters/ads) rather than direct sales time.

Targeting intensity should follow these priorities—not treat every account equally.

2. Align Your Sales Pitch with Prospect Needs Using Technographic Intelligence

Technographic data reveals how a prospect buys—not just who they are. Understanding a company’s tech stack helps identify:

- Where you can replace a competitor (tools they’re already using)

- Where your product can plug in easily (complementary platforms in place)

- How ready they are to adopt something new (early-stage vs. mature stack)

- What their tech stack says about budget (enterprise-grade vs. starter tools)

For example, a prospect using HubSpot Free + Mailchimp + Zapier is a different opportunity than one using Marketo + Salesforce + 6sense. The former uses multiple low-cost, disconnected tools, indicating an intent to graduate to an integrated solution. The latter signals enterprise-level maturity and a large budget, so they will not be open to an ‘all-in-one’ pitch but rather to specialized capabilities that outperform their current stack.

Likewise, you can use technographics to:

- Identify prospects in your market category

- Map complementary systems

- Spot gaps that indicate unmet needs

3. Engage at the Right Moment with Intent Signals

Solution alignment without matching the timing of the sales pitch wastes effort. By combining profile fit (who to target) with intent signals (when to engage), you transform generic outreach into a strategic intervention, turning cold prospects into warm opportunities.

Enrich CRM data with high-impact intent signals such as:

- High-frequency website visits or pricing page views

- Bottom-funnel content downloads

- Job changes in relevant buying roles

- Funding announcements or expansion news

- Technology adoption or replacement activity

These signals indicate active evaluation—not passive interest—allowing sales and marketing to engage when conversion probability is highest.

Predictive Lead Scoring Powered by Enriched CRM Data

Once high-intent audiences are built, you can begin prioritizing leads.

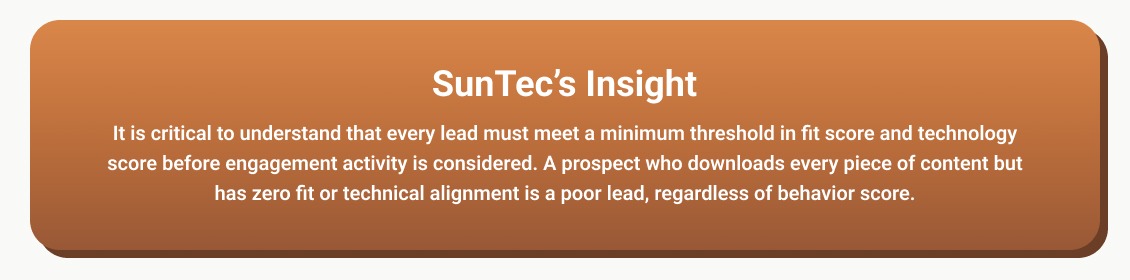

Not every ICP-fit account is ready to buy at the same time, and treating them equally slows pipeline momentum. This is where you can utilize enriched CRM data for decision-making—by powering predictive lead scoring that tells sales exactly who to engage, when, and why.

Traditional lead scoring fails because it relies on surface-level activity without context.

- Someone downloads a whitepaper and receives 10 points

- Opens three emails, gets 15 points

- Reaches 100 points, gets passed to sales

The problem here? These scores ignore context.

Enriched CRM data enables a more innovative approach: contextual, predictive scoring that combines behavioral signals with fit data.

So, here’s the methodology we recommend for optimal lead scoring:

Our Multi-Dimensional Enrichment Lead Scoring Model |

|

1. Fit Score (Firmographic Alignment)This score shows how closely a lead matches your Ideal Customer Profile (ICP). It uses enriched company data to evaluate whether the account is a strong fit based on your historical closed-won patterns. Example scoring:

A higher Fit Score indicates the company is very similar to accounts you have successfully closed. |

2. Technology Score (Stack Compatibility)This score evaluates a lead’s technical environment using technographic-enriched data. It helps you assess their readiness, competitive position, and potential for integration. Example scoring:

A strong Technology Score highlights accounts that are technologically aligned with your solution. |

3. Engagement Score (Behavioral Signals)This score shows how actively the lead is interacting with your brand. Unlike traditional scoring, these behaviors are now interpreted in the context of their Fit and Technology scores—so every action becomes more meaningful. Example scoring:

A higher Engagement Score indicates rising interest and readiness to evaluate solutions. |

4. Timing Score (Trigger Events)This score captures real-time signals that indicate a current buying window. These enriched trigger events help you identify when an otherwise “good fit” lead becomes a “right now” opportunity. Example scoring:

A high Timing Score signals that the account is actively preparing to make decisions now. |

So,

A Lead’s Total Score = (Fit + Technology + Engagement + Timing) Scores

The Impact: From Lead Volume to Pipeline Velocity

When lead scoring is powered by enriched CRM data, sales teams stop chasing activity and start pursuing intent. The result is fewer wasted handoffs, higher-quality conversations, and a pipeline built on readiness—not noise. This ensures sales effort is spent where conversion probability is genuinely highest.

Activating Enriched CRM Data Across Your Revenue Channels

Lead scoring tells you who to prioritize—but revenue acceleration depends on how teams engage next. Enriched CRM data delivers its full value only when it actively shapes execution across channels, guiding messaging, timing, and channel selection in real-world workflows.

This is where CRM enrichment moves from data updation to action.

1. Email Campaigns: Where Precision Beats VolumeProblem: Generic email blasts ignore CRM intelligence Activation: Build micro-segments using layered attributes

Impact: Contextual messaging, higher opens, warmer replies |

2. Paid Advertising: Spend Only on Verified OpportunitiesProblem: Broad targeting wastes budget Activation:

Impact: Lower CAC, higher relevance, cleaner pipeline contribution |

3. Sales Outreach: Turn Research Time into Selling TimeProblem: Reps spend hours researching before first contact Activation: Surface-enriched insights directly in CRM

Impact: Smarter first conversations, higher connection rates, shorter cycles |

4. Account-Based Programs (ABM): Coordinate Multi-Stakeholder EngagementProblem: One-size messaging fails in complex deals Activation:

Impact: Stronger ABM performance, higher deal velocity, better win rates |

Measuring the Revenue Impact of Business Data Enrichment

B2B CRM data enrichment earns its place only when it moves pipeline metrics. High-performing teams measure the impact of record enrichment through a defined set of revenue-linked KPIs:

Campaign Response Metrics

Track open rates, click rates, and reply rates for enriched vs. standard segments. Higher engagement confirms targeting precision.

Pipeline Velocity Improvements

Measure time from first touch to qualified opportunity. Faster progression signals better-fit leads and relevance.

Deal Value Analysis (ACV)

Compare Average Contract Values (ACV) from enriched-sourced deals. Higher ACV validates account prioritization.

Cost per Qualified Lead (CPL) Efficiency

Calculate Cost-per-Qualified-Leads (CPL) from data enrichment + campaign cost divided by qualified leads. Declining CPL confirms better ROI.

When these metrics improve together, CRM data enrichment proves its value where it matters most—pipeline quality, speed, and revenue.

Tracking CRM Data Enrichment Attribution for Revenue Impact

You can also identify which enrichment efforts drive revenue. Tag your CRM records based on how enriched data contributed to progression.

For this, you can use three clear attribution markers to label records:

- Enrichment-Identified: Leads discovered through enriched audience targeting (e.g., new ICP-fit accounts surfaced via firmographic/technographic data).

- Enrichment-Scored: Records prioritized using enriched attributes such as growth signals, technology usage, or funding data.

- Enrichment-Engaged: Outreach personalized using enriched intelligence (job changes, recent funding, stack gaps, intent signals).

Track these tagged cohorts through each pipeline stage to reveal:

- Which enrichment use cases accelerate deal movement

- Where enrichment improves deal size or conversion

- Which data investments directly contribute to revenue

This attribution approach can turn CRM data enrichment from a background data task into a measurable revenue driver, making it clear which enrichment decisions deserve continued investment and scale.

Conclusion: Treat B2B CRM Data Enrichment as a Competitive System, Not a Project

The required paradigm shift is from reactive database cleanup to proactive intelligence gathering. When you enrich CRM data at scale, you’re not just filling fields—you’re building a commercial intelligence asset that compounds in value over time.

Here’s what we tell our clients: execution matters far more than tools. You can buy access to some of the best CRM data enrichment tools on the market, but without the right strategy, prioritization, and activation workflows, they deliver little value. The most complex enrichment challenges—balancing coverage with cost, maintaining accuracy at scale, integrating across systems, and continuously refining targeting models—require both technology and specialized domain knowledge.

So, if your CRM is cluttered, your targeting is imprecise, and your sales team is drowning in low-quality leads, the path forward is clear: strategic CRM data enrichment aligned with sales & marketing strategies and revenue workflows.