Mortgage Bankruptcy Records Entry Services

For mortgage companies, private lenders and financial institutions dealing with foreclosures due to bankruptcy filing by clients is a routine business. Any person or organization can file for bankruptcy in the United States due to financial distress. For protection of the rights of people facing financial difficulties, the bankruptcy process is governed by federal courts. You as a lender or a mortgage company are legally bound to follow the court procedure in dealing with bankruptcy cases. Following this legal and ethical norm is easier said than done as the whole process involves handling a humongous amount of paperwork and accurate processing of real-time data. Taking care of this legal function also eats into your financial resources and productive time. You can save big time on both these attributes and still meet the statutory needs by outsourcing mortgage bankruptcy records and assets & liabilities services.

SunTec India is your ideal outsourcing partner for all sorts of mortgage services . With over two decades of dominating presence in the outsourcing arena, we have helped thousands of our esteemed clients in improving their operational efficiency and bottom line. As part of our mortgage and real estate services , we handle all your bankruptcy records lookup and data entry needs.

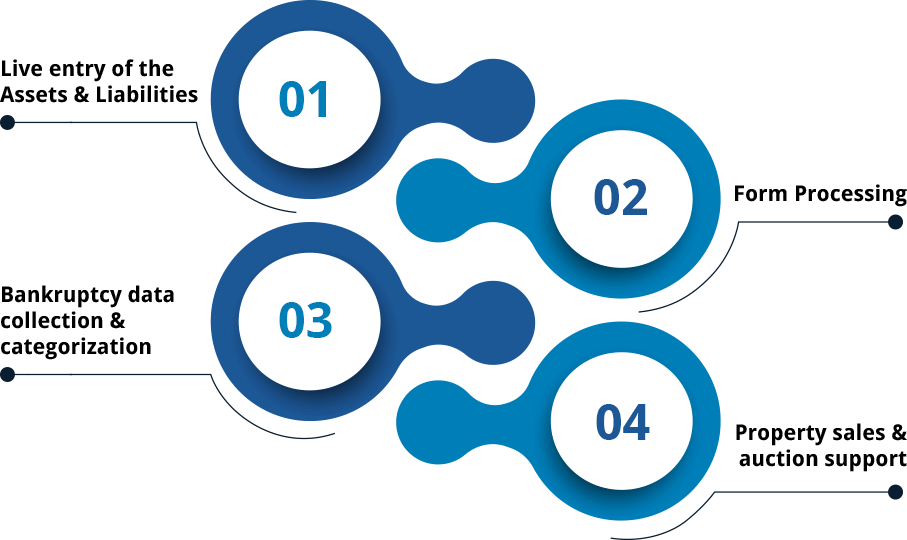

Live Entry of the Assets & Liabilities

Our experienced bankruptcy data experts are well versed with the bankruptcy processes followed in different states. They collaborate with your in-house team to collate and process the data as per your individual needs. To perform the live entry of the Assets & Liabilities amount and Sale Assets on your website, we first download the PDF from the mail that you send us. We further categorize the PDFs in three formats, namely Form 201, Form 101, and Form 404 - Foreign Proceeding.

Form Processing

To process the Form 201 we can filter out the information as per your needs from the PDF and upload it on your website.

- Assets,

- Liabilities,

- Industry,

- Chapter 11 Type

- Website

In Form 101processing our experts filter out assets and liabilities from the PDF and upload the information on your website.

Bankruptcy Data Collection and Categorization

Having worked for a variety of lenders in the US, we have developed an in-depth understanding of the bankruptcy filing procedures followed in the US. Our bankruptcy records entry experts can workaround Voluntary Petition for Non-Individuals/Individuals. They are adept at finding out information such as affiant/attorney, their email address, and sale assets. After collecting this data they further categorize it as "Personal Property", "Real Property" and "Business Property" Personal/Real/Business Property are further segregated into "subcategories" respectively.

Property Sales and Auction Support

As a bankruptcy records entry service provider we take care of the whole process of property sales and auction. Our experts first give an interesting title to the property by incorporating item type and item brand in it. Then they describe the assets for sales by doing thorough research on Google and the provided documents. You can also leverage their expertise to find and record information ranging from sale date, sale hearing date, objection deadline to bidding increment amount at auction and estimated value of the sale assets. By assisting you with all these aspects of bankruptcy records we aim to smoothen your operations and free up more resources to take care of your core business.

SunTec India: Your Ideal Partner to Outsource Bankruptcy Records Entry Services

SunTec India is an outsourcing service provider that brings to the table more than 25 years of experience in delivering bespoke solutions to a worldwide clientele. Our in-depth understanding of the mortgage industry and an experienced team of experts make us the preferred choice of lenders who seek dependable mortgage bankruptcy records services. We offer the widest range of mortgage services under one roof. With us, you can hire dedicated experts who work exclusively for one client at a time. These experts can work in close coordination with your in-house team to deliver customized solutions within a quick turnaround time. Being an ISO certified services provider, we offer world-class data protection and unmatched quality of services.

Benefits of Outsourcing Mortgage Bankruptcy Services to SunTec India

Explore the pros of trusting your critical and confidential documents in the hands of our experts.

Data Security

We keep your mortgage records confidential via advanced encryption algorithms, NDAs, and secure transmission channels.

Quick Delivery

With all our clients so far, we have established a record of delivering every project on time, regardless of the hitches we face on the way.

Scale at Will

With a dedicated team available to you on a need-basis, we give you a choice to scale up or down without any hassle.

Budget-Friendly

Not only do we follow competitive pricing for our services, but we also help you save up to 50-70% on outsourcing.

Rich Tech Culture

Get access to state-of-the-art infrastructure, the latest and best technologies, tools, and industry-favored practices, all in one place.

Communication

We maintain constant communication with our clients via a dedicated project manager. They ensure that you stay in the loop and are informed of every step.

Transform your processes and amplify our operational excellence with 360-degree mortgage bankruptcy records entry services from SunTec India. Reach out to us at info@suntecindia.com to discuss requirements, get assistance with any query, or book a free demo session with our professionals.

Client Speak

Before partnering with SunTec India, I thought outsourcing is still a far fetched dream for mortgage companies as one cannot find the key skill sets in a remote location. But SunTec broke my notion by providing me with the required talent and experience. Not only this, my remote resources were well versed with the US regulatory guidelines. They could process Form101, Form 102 and every other data with compliance. Their professionalism and language proficiency was like an icing on the cake. I am willing to vouch for the quality and accuracy of their mortgage services .

CEO of a leading firm in US