Mortgage Lien Release: The Easiest Way To Go

Each one of us is ambitious for a dream house, where we can settle down and relax, and carry on with life as we would love to. Financing plays a major role in realizing this dream. Mortgage services come in handy while making financial plans to move into a house of your choice.

Paying off the Mortgage gives a sigh of relief, but wait! Before you enjoy the couch in the house, remember the crucial task of Mortgage Lien release needs your attention.

What is it? How do you do it? And How can a Mortgage lien support service help? Read through for the information

Table of Content

What is a Mortgage?

Financing institutions provide the facility of Mortgage style of financing. This means the institution will provide a loan, keeping the property as a guarantee against the payment it expects in return. A borrower can receive this credit to buy the property, or to fulfill any other legitimate financial requirements.

In America, old age people often opt for Reverse mortgage services

What is meant by a ‘Lien’?

A lien is a legal claim on an asset, which is held by the creditor as a covenant against the amount it has lent to the borrower.

Till the loan is paid off in full, the creditor has the lien on the asset. It can exercise its right by selling over the asset if the debtor fails to pay the loan.

As its payments are cleared borrowers can begin the procedure of transferring the asset title in their name.

Concerning Mortgage, a lien can be classified into two categories:

First Lien

Most consumers use this facility to buy their dream home. It’s a type of lien where the property serves as collateral for the financial credit granted to the buyer of the respective house.

Second Lien

To fulfill other financial needs, if the borrower seeks a loan with the property as collateral, while the first lien still stands, then this is termed the second lien.

Getting acquainted with Mortgage Lien

It is the term given to a transaction of financial credit based on a property, and the respective property gets under the lien of the creditor.

That is if someone takes a loan based on a property, the asset’s title is under the creditor’s hold.

The lending authority can use the property to settle the loan default if the repayment does not happen as documented.

Mortgage lien services can be used by individuals to secure a home, as well as by businesses or firms to manage funds.

Based on the type of approach Mortgage lien can be classified as

Title theory

Here, the creditor keeps the legal ownership of the property, allowing the borrower to utilize it for living till the time the loan gets paid off. The borrower is granted an equitable title by the creditor, which he can recall on default of the Mortgage contract.

Lien theory

The creditor holds a Mortgage lien over the property, while the borrower can get the legal ownership title. The property serves as an interest of the creditor, which can be encashed to get the required outstandings of the loan. The borrower, though holds legal ownership, cannot sell the property as the records define title status under Mortgage lien.

Paying off the Mortgage

Remember paying off the Mortgage is not just about following your statement records, there is more to it and you cannot afford to miss it either. Here is a step-by-step method:

- Ask your creditor for a payoff letter, it must include – payment dates, the total amount including interest, penalties, foreclosure charge, and the account information.

- Document checklist

- Canceled Promissory note

- Deed of trust or Mortgage deed

- Certificate of Satisfaction

- Final Mortgage statement

Once you have all the prerequisites, next:

- Pay the amount quoted in your payoff letter, using the information mentioned and the method notified.

- Get the receipt of your payment

- Get the payoff recorded with the local government and also take a copy of this note.

Please be aware that if you miss the deadline mentioned in the payoff letter, you may have to pay the extra interest or penalties too. Calculate Mortgage closing costs beforehand to be well prepared.

Wait a minute! that is not enough after you are done with the above-mentioned formalities:

- Make sure to cancel all auto-debits, it will save you from a headache later.

- Make sure to receive refunds for your escrow.

- Let your local tax collector know that you will be paying the taxes here.

- Similarly, let the insurance provider know that you are now the liable person to pay the premiums

- Gather all the homeownership documents and receipts. The file will be required in further procedures.

- Title insurance is important to deal with any defects which may come up later, it is advised to keep it going.

The Mortgage Lien Release Process

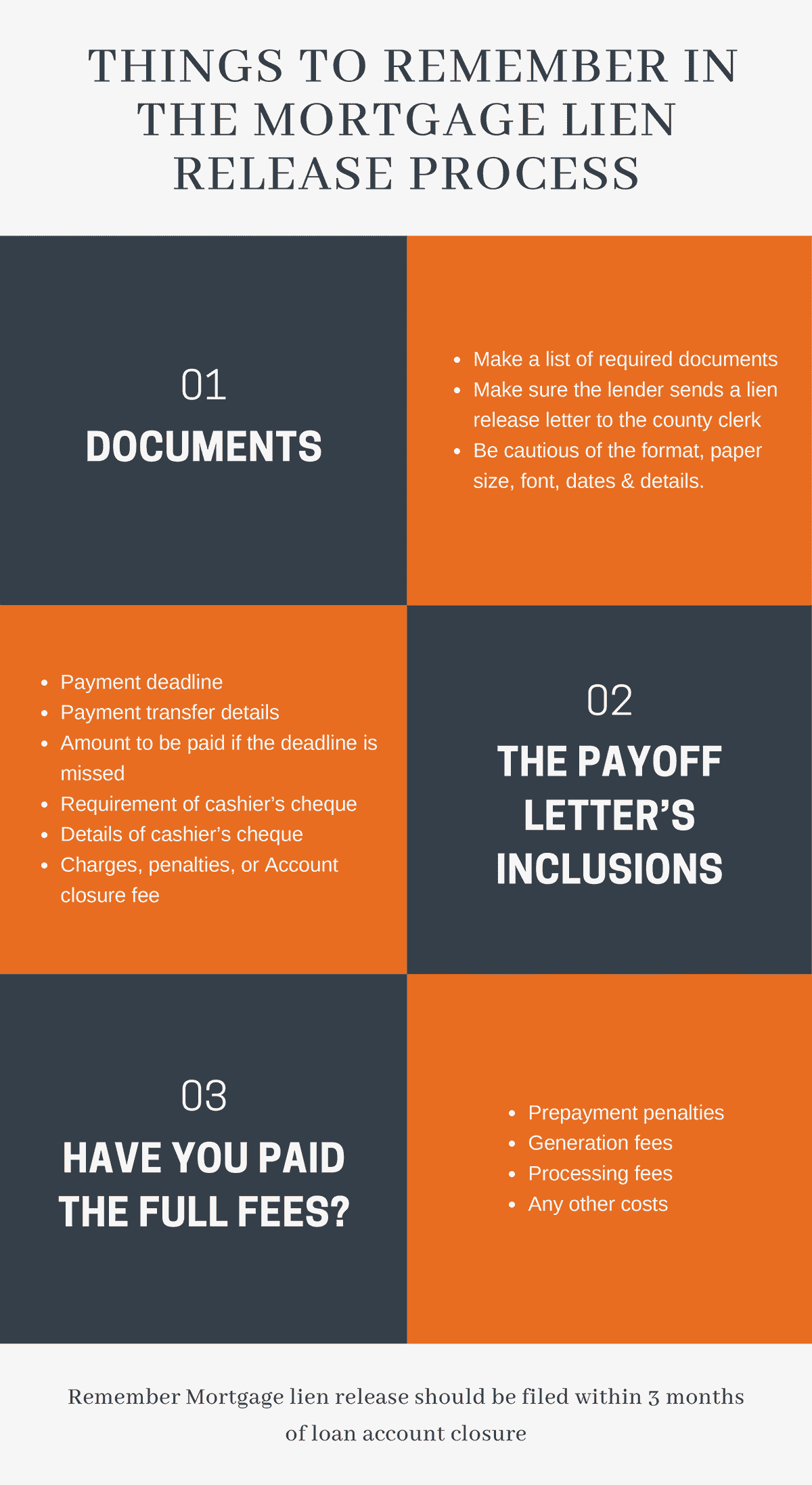

Mortgage lien release requires the borrower to be on toes, as it is quite detailed and even a little carelessness may result in all hard work going in vain. Due to this nature of the process, a good number of buyers are turning to the Mortgage lien release services.

Once the debt is paid off, a borrower is required to begin the lien release process within 90 days.

To get your Mortgage lien released, it is important to prepare all the required documents and apply to the respective county office in the prescribed format. You should observe, check and recheck every detail minutely, and leave no room for mistakes.

-

- Get a payoff letter from the creditor

It should include the total amount till-date with interest and penalties. The date of payment and account details should be noted in the letter.

- Make payment as per the mentioned details, and take receipts.

- Ask for a payment clearance letter or full payment receipt from the creditor

- Get a release of lien or Certificate of satisfaction

- Submit all the required documents along with the lien release request letter to the local county’s office

- The county’s office or the land records office shall give the lien release letter after auditing the documents

However, if the county’s office finds some discrepancies with the documents, or finds that you have missed any record, fee, or clearance; this will result in your application being rejected.

Borrowers are engaging virtual assistants for Mortgage lien release support to sail through the process.

Problems faced by borrowers in lien release

American Land Title Association, reported that more than a third of property transactions have title release issues. Another estimate If a problem exists on such a large scale, it proves that the process of Lien release isn’t followed carefully.

Borrowers faced the following issues with the Mortgage lien release:

- Arranging documents

- Preparing forms, applications, and documents in a proper format

- Following up in county office along with liaison at creditor’s office

- Managing routine jobs with the release task

- Loss of time and money in case of a rejection

- Stress, anxiety, and frustration

Aren’t you happy even after paying off the Mortgage?

Is the lien release process giving you nightmares?

Then you should utilize professional Mortgage Lien release support services and see SunTec India’s skills and experience do the job for you.

Why a lien release gets rejected

A mortgage Lien release is a lengthy process, Uniform Residential Mortgage Satisfaction Act (URMSA) was created to minimize the rejection rate and make the process easier. However, there can be ‘n’ number of reasons for the rejection of your application, such as

- The Application was prepared in improper font

- The margins in the application are too big/small

- The size of the paper is unacceptable

- Unrecognizable witness signature

- Incorrect fee calculation, or outstanding payments

- Issues with dates

- The Notary is not up to the mark

- Documents submitted to the county were incorrect

- Failure of identifying the right county

- Wrong history or records data

These are the only superficial reasons, the list is long. If federal and investor grounds for lien release denial are included, this list may go on for pages.

How will the rejection affect you?

It was the right choice to postpone the Mortgage payoff celebration and focus on the lien release first. As the release gets rejected it’s not only painful, but the loss of time and expenses hurt even more.

According to the data of Ernst Information services, every year 10 million documents get rejected by 3600 county recorders in the United States, resulting in around 500 million financial losses. It was observed that between 12 to 13 percent of lien release applications get rejected, leading to a loss calculation of 50$ per denial.

Without the Mortgage lien’s release, one cannot get the title transferred. If the borrower wants to sell off the property, a title check done by the real estate attorneys will raise doubts.

Rejection of release creates a threatening situation for borrowers as the title is yet to be freed and transferred. It may also lead to penalties for non-compliance. Unless you have outsourced the job to a Mortgage lien release company, you should do the preparation, application, and tracking, all by yourself.

The borrowers facing such a situation get frustrated. It is also stressful to complete the formalities and re-apply within the timeframe.

The easy way to deal with the Mortgage lien release process

Do you find the process very exhausting? Is it difficult for you to find out the time and risk costs involved in the process?

There is a sure way out. Get the Mortgage lien release support service help. The mortgage lien release company has the required skills, infrastructure, and experience to gain approval from the county.

Mortgage lien release support services can do the following tasks for you:

-

- Mortgage Lien Release Processing

The service includes preparing required documents, verifying Mortgage assignments, and getting them validated.

-

- Mortgage assignment services

The sale of the Mortgage to another Creditor or third party by the financing authority is recorded as a Mortgage assignment. Support services take the responsibility to secure these documents for you.

-

- Tracking and reporting

Mortgage Release Support services to have a system in place like CRMs, which track and update documents and tasks on a timely basis.

- Document recording

- Document retrieval

Finding a Mortgage lien release support service

The Mortgage Lien release is a complex task. Assigning it to an outsource partner saves you time and money, you should be very cautious in choosing a support service for the task.

Here are a few points which will make the choice easier for you:

- Mortgage lien release requires record scrutiny, document preparation, coordinating with various offices, tracking, and reporting.

- It is best to find an experienced Mortgage lien release support assistants

- The support should be skilled in Mortgage laws and finances

- Eye for detail

- Delicate handling of data and recordings

- Mortgage lien release support services should have a robust system in place for better customer report management

- Keep track and send timely reports

To sum it up

It is estimated that Mortgage Lien release rejection approximately cost 50$ per denial, the loss of time and energy is another thing. A Borrower has to do the hard work of preparing documents, coordinating with the notary, lender, county office, and attorneys, along with arranging funds and making payments. All this with the daily chores of life. Assuming that the lien release application is rejected, none can enumerate the frustration.

Engaging a Mortgage lien release company can save you the headache. A Mortgage lien release processing services staff will do the job for you while you can sit back and relax.

SunTec India’s Mortgage Lien Release Services

If you are looking for a smoother way to Mortgage Lien release, outsourcing would be a considerable option. We have an experienced team of skilled professionals who can address the complexity of the Lien release process.

We have developed an efficient system to reduce the risk of rejection through a flawless workflow. All this enables a sure shot impression on the county resulting in achieving a quick lien release.

SunTec India is equipped with next-generation technology and world-class infrastructure. The team’s skilled professionals are well acquainted with the lien release process, they will audit your mortgage assignments, notes, deeds of trust, and other required documents; to leave no loophole in the application.

Our Mortgage Lien release Support Services include:

-

- Mortgage Risk Management

Starting from accessing pending taxes, ownership disputes, and litigation; We review all requirements for the release process to sail through. We make sure that the loan is protected by the title policy regulations keeping insolvency risk at bay. We also keep an eye on any assignment changes made to the property.

-

- Mortgage Lien Release Processing

Our skilled and experienced professionals create a strong strategy to speed up a successful lien release process. The technically upgraded system, report, and follow-up management has given us many satisfied clients. Document retrieval, verifying mortgage assignments, and validating them are part of our job. Precision and monitoring are key to a successful application to the county. We work closely with all stakeholders to achieve the goal, in-time.

-

- Tracking & Reporting

Our specialty is the technically upgraded CRM systems, coupled with the skills of our team, we track and report proceedings on the documents in real-time. To keep the clients informed about the status of their application, and respond to the queries of stakeholders makes us unique.

-

- Document Recording

Our top-notch document management system records and saves a digital copy at every stage of the Mortgage lien release process, which makes the tracking flawless. Creating a digital record eliminates manual errors and improves the efficiency of the tracking process.

Salient features of SunTec India’s Mortgage lien release services

- Data & Image Recording

- QA & Control

- Assignment chain verification

- Lien release document handling

- Exception handling

- Database /management

- Collateral handling

- County / Municipality record check

Are you yet to begin the Mortgage Lien Release process?

Are the documentation and follow-ups exhausting for you? Or You have lost hold of a missing document?

Don’t you want to save money, time, stress, and rejection?

Get our experienced Mortgage Lien Release professionals to work.