Mortgage Lien Release Services

Mortgage lien release could be a nerve-wracking task for lenders if they are not aware of the mortgage laws and compliances. Even after successful loan repayment, the lien release can be rejected by the county if assignments are not done precisely or documents are missing. As a lender, you can overcome this hassle by outsourcing mortgage lien release support services to someone who knows the drill. This will not only save you a high closing cost loss but also free up your workforce from doing time-intensive routine tasks. At SunTec India, we have skilled professionals who are not only familiar with the latest mortgage laws but also know how to streamline your mortgage lien release process. With our professionals' expertise on your side, you can reduce the rejections by the county.

When you hire mortgage lien release service experts from SunTec India, we take charge of your complete lien release process. Our experienced mortgage specialists provide end-to-end back-office support, right from document generation to recording and tracking. We follow a streamlined workflow structure to cut down the time taken for assignment generation, recording the loan documents, tracking, reporting, and document retrieval.

Why Should Businesses Outsource Mortgage Lien Release Services?

Mortgage lien releases can be rejected for several reasons. These include missing payoff letters, recording errors, confused property history records, municipality or county mix-ups, illegible signatures, even something as trivial as wrong font or margins.

Each release rejection causes monetary harm.

To curb such closing cost losses, businesses need to pay attention to every error and fix it immediately. While a perfect process, in theory, it is overwhelming in practice because of the volume of mortgage loans processed every month and the quality & precision required for them. You will need a fully furnished post-closing department to accomplish this task, which requires investment, time, and monitoring.

Outsourcing solves that problem, saves your time and money, and protects your organization from opportunity losses. Here’s how:

- High volume document processing

- Multiple QA cycles to ensure negligible errors

- Quick turnaround

- Release tracking to avoid any post-closing issues

- No additional time or effort required from your team

You get the assurance of pristine mortgage lien release documents. Your team gets the time to focus on more critical tasks. It’s a win-win!

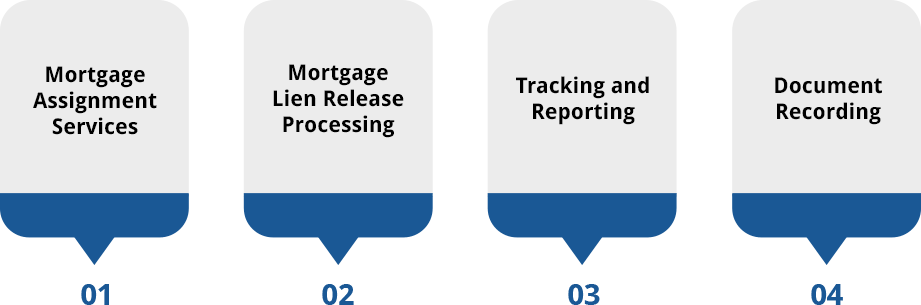

A Glimpse of our Mortgage Lien Release Services

Mortgage Assignment Services

Our talented and experienced professionals have rich expertise in mortgage risk management. We not only bring unpaid taxes, ownership disputes, and litigations to the lender's notice but also assess all the assignments that are involved in the mortgage. We protect lenders from the insolvency risk by ensuring that the loan amount does not surpass the property value. This is done by validating that the loan is protected by the title policy regulations. Moreover, we closely monitor and track the assignment changes made to the property by using it as collateral.

Mortgage Lien Release Processing

Backed by the latest technology and skilled professionals, we provide all-inclusive mortgage lien release support services to our clients. Upon receiving the request for lien release over mail, fax or SFTP, we start planning the strategy to speed up the entire release process. This includes document retrieval, verifying mortgage assignments and validating them. Our mortgage specialists work closely with all the concerned parties to quickly complete the document verification steps and send it to the county for sign-off. These experts ensure that verification and validation of documents are done with utmost precision. This eliminates the chances of any mistakes that may cause rejection by the county.

Tracking and Reporting

At SunTec India, we have a skilled workforce and access to the latest technology to track the movement of lien release recording and mortgage documents in real-time. This enables us to give you a reasonable estimate of the cost and turnaround time for the mortgage lien release process. Our mortgage specialists employ modern-day CRM systems to generate reports and track data and keep you informed about the performance of your mortgage lien release process in real-time.

Document Recording

Backed by a robust document management system, we keep a digital copy of the status of the mortgage lien release process for hassle-free tracking of documents once the release request is made by the lender. By embracing the digital approach, we not only eliminate redundancy but also improve the overall efficiency of the lien release process.

Why Choose SunTec India as your Mortgage Lien Release Services Provider

At SunTec India, we have experienced professionals who leverage their industry know-how to address the complexity of the lien release process. We have the industry's best workflow that not only enables us to quickly complete the mortgage lien release but also reduces the risk of rejection by the county. Backed with world-class infrastructure and cutting-edge technology, we closely scrutinize mortgage assignment(s), notes, deed of trust, and other important documents to successfully close the lien release process.

Outsource Mortgage Lien Release Services to SunTec India

SunTec India is a leading mortgage lien releases service provider. For 25+ years, we have operated globally and helped numerous enterprises with a multitude of data and IT support services.

Our professionals work exclusively as an extension of your team. We take all the guesswork out of your mortgage lien processing with tried-and-tested processes, advanced technology culture, and expert resources. We handle everything from fonts and typos to regulation adherence, formatting, form processing, preparation, data recording, and lien release tracking post-closing.

Our comprehensive mortgage lien release services leave no stone unturned to simplify the process for you.

- Data & image recording

- Assignment chain verification

- Lien release document handling

- Exception handling

- QA & control

- Database management

- Collateral handling

- county/municipality record review

Discover the operational efficiency that a competent mortgage lien release service provider can bring to your organization. Join hands with us! You can send us your requirements at info@suntecindia.com. You can also book a free demo with us before starting the project.

Know Your Candidate Ltd-- Barry Hetherington

Managing Director

Know Your Candidate Ltd. Manchester UK