- Introduction

- The Comfort Trap: Mistaking

Speed for Accuracy - Where Automation Quietly Fails

- What the Data Says that the

Market Ignores - How Smart AP Leaders Stay Ahead:

Humans-in-the-Loop - Our Playbook for Closing the Accuracy

Gap in Automated Invoice Processing - Don't Let "Good Enough" Define Your

AP Best Practices

Across industries, CFOs often cite 90% accuracy in automated invoice processing as a key milestone in digital transformation. At first glance, it does look like a victory—transactions once processed in days now flow through in hours. With advanced optical character recognition, improving contextual intelligence, and continuously learning algorithms, enterprise AP platforms have evolved beyond basic automation toward genuine document intelligence.

Yet our analysis of more than 250,000 invoices across clients using AP automation tools (in diverse industries including manufacturing, healthcare, and retail) in 2025 highlights what hides at the edges: the remaining 10% is not a rounding error. It is a systemic risk that compounds into regulatory penalties, vendor disputes, and financial leakage running into millions annually.

More critically, it fosters a false sense of security. By declaring victory at 90% accuracy, organizations overlook the persistent gap that quietly drains millions from their bottom line and erodes the trust needed to scale automation responsibly.

The paradox is that the more confident teams get in their automation, the less seriously they treat the exceptions — and that’s exactly where the real risk lives.

The Comfort Trap: Mistaking Speed for Accuracy

The digital transformation narrative has seduced finance teams into believing that faster processing automatically equals secure processing. This fundamental misconception is why relying on AP automation is risky without proper safeguards in place.

Consider this: if a company processes 10,000 invoices a month at 90% accuracy, 1,000 of those invoices will still contain errors. Some will be small—like a misplaced decimal or an incorrect tax rate. Others will be far more costly, such as duplicate payments that drain working capital, mismatched purchase orders that trigger disputes with vendors, or fraudulent charges that slip through undetected.

And the damage doesn’t stop at the immediate dollar loss. Every error adds friction:

- Vendor Relationship Damage - Late or incorrect payments strain supplier relationships and reduce a company’s leverage in future negotiations.

- Compliance Violations - Recurring error patterns that slip past automated checks turn regulatory audits into compliance minefields.

- Internal Resource Drain - Exception handling forces finance teams to spend disproportionate time firefighting instead of focusing on strategic planning.

- Fraudulent Behavior - Fraud schemes exploit blind spots in automated processing and validation, exposing enterprises to hidden financial risks.

The harsh reality is that these errors aren't random occurrences—they follow patterns that standard AI models aren't trained to recognize.

Where Automation Quietly Fails

Our team has identified a recurring pattern: automation works well for the straightforward cases, but it consistently stumbles at the edges where context, judgment, and cross-system reconciliation matter most. These edge cases are not occasional. They represent systematic vulnerabilities that create predictable blind spots in automated invoice processing workflows.

Vendor Verification Failures

Automation can validate vendors against a master list but only if the master data is updated and comprehensive. In reality, it rarely is. Vendor data is usually dynamic and inconsistent across ERP, procurement, and banking systems.

- A supplier recorded as “Acme Logistics Pvt. Ltd.” in one system may appear as “Acme Logistics Ltd.” or simply “Acme Logistics” in another. Automated matching often fails to reconcile these variants, flagging valid invoices as errors.

- Even legitimate vendor updates—like a change in account number—are frequently missed when master data isn’t refreshed, leading to failed or delayed payments.

While these inconsistencies occasionally open the door to fraud, the bigger and more frequent issue is operational inefficiency. Each mismatch creates exceptions that finance teams must resolve manually, slowing down processing cycles and straining vendor relationships.

Invoice Reconciliation Breakdowns

AI models excel at simple one-to-one matches—an invoice that mirrors a purchase order line for line—but falter when complexity multiplies, such as partial deliveries, split billing cycles, or service contracts with variable milestones. Context (timing, delivery schedules, contract terms) isn’t always captured in structured data, making it difficult for automation to apply the right reconciliation logic.

- A purchase order for 10,000 units may be delivered in three separate shipments over a two-month period, with invoices issued accordingly. We have noted that automated AP tools struggle to reconcile such partial shipments against the original PO.

- Across industries like IT services, construction, and consulting, we’ve seen issues in AP automation when processing the contracts billed on milestones—like, 40% upfront, 30% mid-project, 30% on completion. This rarely maps neatly to the purchase order line items and automation tends to stumble with such data validation.

- Invoices denominated in different currencies often misalign due to fluctuating exchange rates. An invoice in euros, matched against a PO in dollars, may pass validation one day and fail the next, depending on the exchange rate used.

Taxation and Compliance Anomalies

Tax-related discrepancies were among the top three categories of exceptions we found – including inconsistent GST treatment on freight, region-specific tax rule changes that weren’t reflected in AP tools, and incorrect application of mixed rates for goods-and-services invoices.

The issue here is that tax compliance isn’t static. Rules vary by jurisdiction, change frequently, and sometimes depend on context—what’s being billed, where it’s being shipped, or how it’s categorized. Static rule sets inside AP platforms can’t keep pace, leading to systematic misclassifications.

Advanced AI/ML models can certainly improve on static rule sets—by learning from historical tax treatments, applying fuzzy logic, and even integrating with external tax engines for real-time updates. However, even with high-end AP platforms, AI cannot inherently detect when a government changes a tax rule; it must be trained to recognize that update. And regardless of the sophistication of the tool, misclassifications will persist in cases that require contextual interpretation and demand human or SME judgment.

At the ROI end, what looks like a small anomaly can snowball into compliance penalties, failed audits, and regulatory exposure. Even when errors are caught internally, the time spent untangling them diverts finance teams from higher-value priorities.

Fraudsters Exploiting Predictable Gaps

Although fraud cases were less frequent in our dataset than vendor or reconciliation errors, the patterns we uncovered were strikingly consistent. The invoice processing team at SunTec has seen:

- Duplicate invoices submitted with only minor tweaks (for example, a single digit changed in the invoice number)

- Fabricated invoices designed to mimic legitimate vendor formats

- Suspicious activity concentrated around “low-value” thresholds—amounts that AP systems often bypass to speed up processing

While automated AP tools can flag unusual payment patterns, vendor behaviors, or invoice structures that deviate from the norm, fraud detection is an arms race. AI strengthens defenses, but the adaptive nature of fraud means automation will always need human or SME oversight as a final safeguard.

Machines don’t intuit context — Humans make that leap instantly; algorithms do not.

What the Data Says that the Market Ignores

Despite these clear, recurring gaps, the broader market narrative continues to portray AP automation as nearly flawless. That’s because for years, the AP automation market has been shaped more by aspirational benchmarks than by real-world evidence.

Vendor and analyst reports emphasize speed, touchless processing, and system-level accuracy, creating the impression that exceptions are rare and steadily shrinking. But our field data tells a different story: in live enterprise AP environments, exceptions remain persistent, structural, and far more costly than market narratives admit.

| What the Market Claims | What Our Data Reveals |

|---|---|

“90–95% accurate touchless invoice processing is possible and becoming standard.” Many AP/AI vendors and reports push toward very high touchless rates. For example, a research on AP metrics by Ardent Partners and Tungsten Automation frames “95% touchless invoice processing” as a goal for modern AP and puts invoice exception rates at 14% in 2024, presented as “manageable inefficiency”. |

The market’s perception of the invoice exception problem underestimates the reality. Our analysis of over 250,000 invoices across manufacturing, healthcare, retail, and tech clients in 2025 shows 10–12% exception rates in routine runs, with rates spiking to 18–20% in complex contexts such as multi-currency reconciliation, split deliveries, and service-based contracts |

“Automation reduces error rates to below 1–2% with OCR + ML.” For more than a decade, analyst reports and vendor benchmarks have circulated the idea that automation can reduce invoice error rates to below 1–2%, often suggesting rates as low as 0.8% under “good automation” conditions. (IOFM, Ascend Software) |

Benchmarks quoting sub-1% error rates measure system-level accuracy in controlled conditions. I.e., they record how often OCR + ML ‘reads’ fields correctly. In live AP, those same systems often mark fields as correct even when the confidence score is low — meaning a human still has to check them. That’s why exception rates remain so high even when automation claims 95%+ accuracy. |

“Standard AI-in-AP workflows can handle vendor validation, matching, and approvals with minimal human input.” Many “touchless AP” vendor claims and vendor documentation emphasize minimal human intervention through PO matching, auto approvals, and other processes. (Basware, Veryfi, and Medius) |

Human or SME judgment remains essential in many cases. In this study, we observed frequent issues like vendor name mismatches, bank detail updates, and legal/tax compliance flags that automation flagged incorrectly or missed—only resolved correctly when humans intervened. |

“AI tools adapt continuously; they learn from exceptions to improve.” Market materials often emphasize continuous system improvement, highlighting factors like “our data extraction engine learns over time”, “automated learning capabilities”, or “improves accuracy over time, reducing manual intervention”, etc. (Basware, Softco, Medius) |

Learning from exceptions is slower and less comprehensive than claimed. In practice, many AI-powered AP tools don’t automatically get updated for region-specific tax changes, extraordinary vendor variations, or edge reconciliation logic. These gaps led to repeated, predictable errors in our experience with invoice processing. |

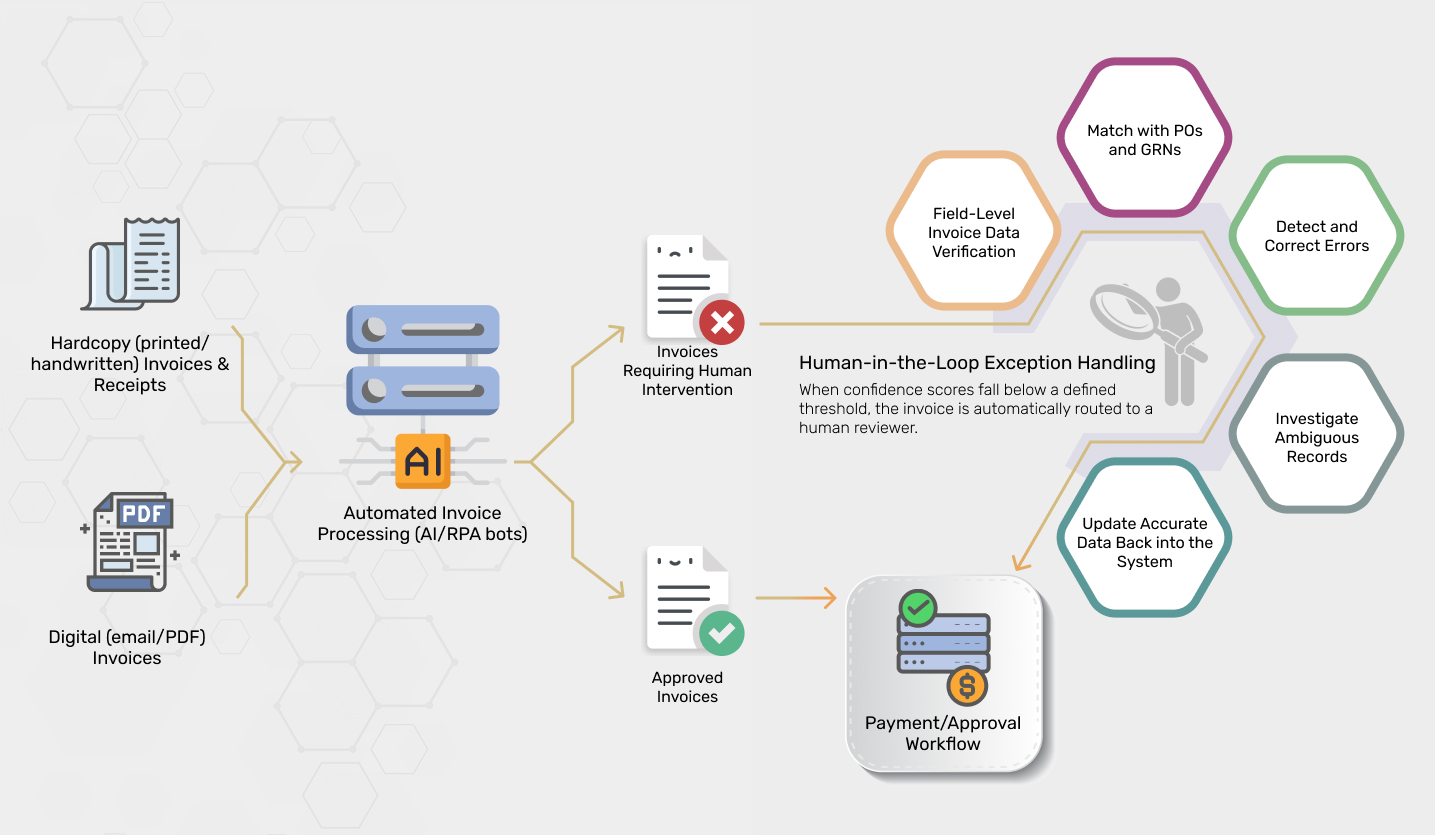

How Smart AP Leaders Stay Ahead: Humans-in-the-Loop

The most successful AP teams don’t view exceptions as failures—they treat them as signals. Each anomaly is data, and therefore, a chance to train systems, refine rules, and anticipate risks.

In my experience, AP teams that embed human-in-the-loop (HITL) strategies outperform generic automation in reducing repeat exceptions. Their approach shifts the mindset from firefighting errors to building proactive intelligence. That’s not just operational efficiency—it’s resilience in an era of rising fraud and regulatory scrutiny.

Here’s how it helps:

- Capture institutional knowledge - Experienced AP professionals detect patterns that AI models miss, creating feedback loops that continuously improve accuracy rates.

- Build industry-specific intelligence - Instead of generic rule sets, the human component of this hybrid workflow can design validation logic tailored to sector-specific invoice issues that they encounter during exception handling or routine data validation (e.g., healthcare reimbursements, multi-currency manufacturing).

- Validate edge cases - When invoices fall outside the “learned” patterns of AI (e.g., one-off service contracts, milestone billing, extraordinary vendor discounts), human oversight ensures accuracy.

- Preserve accountability - Human approvals create audit-ready trails of responsibility that regulators and auditors trust, ensuring compliance beyond algorithmic outputs.

- Bridge cross-functional gaps - Humans coordinate across AP, procurement, legal, and vendor management when exceptions touch multiple domains, preventing silo-driven errors.

The key insight driving this evolution? It’s invoice workflow optimization, i.e., deploying human expertise strategically where it creates maximum value.

Our Playbook for Closing the Accuracy Gap in Automated Invoice Processing

Moving from 90% to near-perfect invoice processing accuracy requires a systematic approach that addresses root causes rather than symptoms. It demands a systematic loop: identify exception patterns, validate them with domain expertise, and feed them back into both process design and machine learning models.

For example, we always report the types of issues and exceptions that come up during invoice data validation for any client. By turning these corrections into structured training data, several of our clients have improved the overall performance of their AP automation system.

Here are some suggestions that have worked for clients:

Quarterly Audits for Exception Pattern Recognition

Implement comprehensive quarterly reviews of all invoice exceptions to identify repeat offenders and systematic vulnerabilities. Track metrics including:

- Exception frequency by vendor, category, and amount threshold

- Time-to-resolution patterns that indicate process bottlenecks

- Cost impact analysis for different exception types

- Seasonal variations that affect automation performance

Integrate Advanced Vendor Verification protocols

Deploy multi-layered vendor verification protocols that go beyond basic matching:

- Real-time banking detail verification through secure APIs

- Cross-reference vendor information against global watchlists

- Implement behavioral analysis to detect unusual invoice patterns

- Establish vendor communication protocols for significant changes

Transform Corrections into Training Intelligence

Every manual correction represents valuable training data for improving automation accuracy:

- Document the reasoning behind each manual intervention

- Create feedback loops that update AI models with verified corrections

- Establish approval workflows that capture expert decision-making logic

- Build institutional memory that survives personnel changes

Implement Predictive Risk Scoring Algorithms

Develop proprietary risk scoring algorithms based on your organization's specific vulnerability patterns:

- Weight scoring factors based on historical exception data

- Adjust thresholds seasonally to account for business cycle variations

- Integrate external data sources for enhanced fraud detection

- Create automated escalation protocols for high-risk invoices

But This Isn’t the Whole Playbook

What I’ve shared here are the fundamentals — the visible part of the process that any strong AP team should already be doing. The real competitive advantage comes from what sits beneath: how humans apply judgment when automation stumbles.

From spotting intent behind an irregular invoice to deciding when to escalate an anomaly before it snowballs into risk, these instincts can’t be reduced to a rule set or coded into a model — they come from experience.

And that leads to the bigger question: are you prepared to rely on “good enough” automation, or will you close the final gap by positioning human expertise where it matters most?

Don't Let "Good Enough" Define Your AP Best Practices

Good enough isn’t neutral — it’s expensive. Every error you accept today becomes the benchmark your systems will replicate tomorrow.

While you're celebrating 90% accuracy, your competitors are building AI systems that learn from every error in real-time. They're implementing digital transformation in finance strategies that turn exceptions into intelligence, problems into competitive advantages.

The uncomfortable truth is this: if you're not systematically closing that last 10% accuracy gap, you're training your systems to keep making the same expensive mistakes. Every uncorrected error teaches your AI model that the mistake is acceptable. Every exception you treat as an isolated incident represents missed intelligence that could prevent future problems.

The solution to invoice automation gaps isn't more sophisticated AI—it's the strategic integration of human expertise where automation falls short. Organizations that master this integration don't just achieve higher accuracy rates; they build self-improving AP systems that continuously improve their competitive position.

It's a strategic move - leading finance teams are integrating human oversight precisely where automation falls short—will yours?

Rohit Bhateja

Rohit Bhateja, Director of Digital Engineering Services and Head of Marketing at SunTec India, is an award-winning leader in digital transformation and marketing innovation. With over a decade of experience, he is a prominent voice in the digital domain, driving conversation around the convergence of technology, strategy, customer experience, and human-in-the-loop AI integration.