Workflow

Our client is a mid-sized commercial finance firm operating across the North American middle market. They specialize in business credit and asset-backed loans, managing hundreds of new loan applications monthly.

The client faced stiff competition from other agile FinTech firms as they were still relying on legacy systems and manual processes for due diligence (verifying complex documents like financial statements, tax returns, etc). They were struggling with:

To overcome manual workflow inefficiencies, the client was looking for a workflow automation and document processing solution that would securely handle all client data while adhering to privacy regulations (CCPA, SOC 2, etc). This solution should:

We engineered a secure, cloud-native IDP and automation platform hosted on AWS. The platform is designed with a microservices architecture to isolate tasks, a DynamoDB/Amazon RDS database for a single source of truth, and a custom-trained IDP module with a dynamic workflow engine to automate the entire due diligence process.

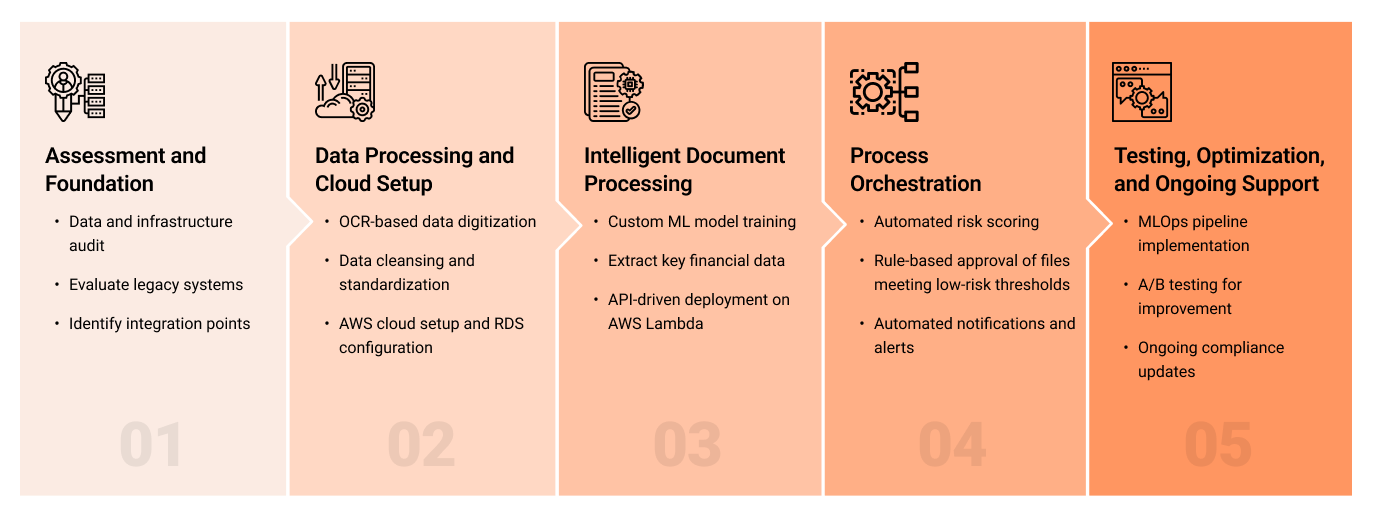

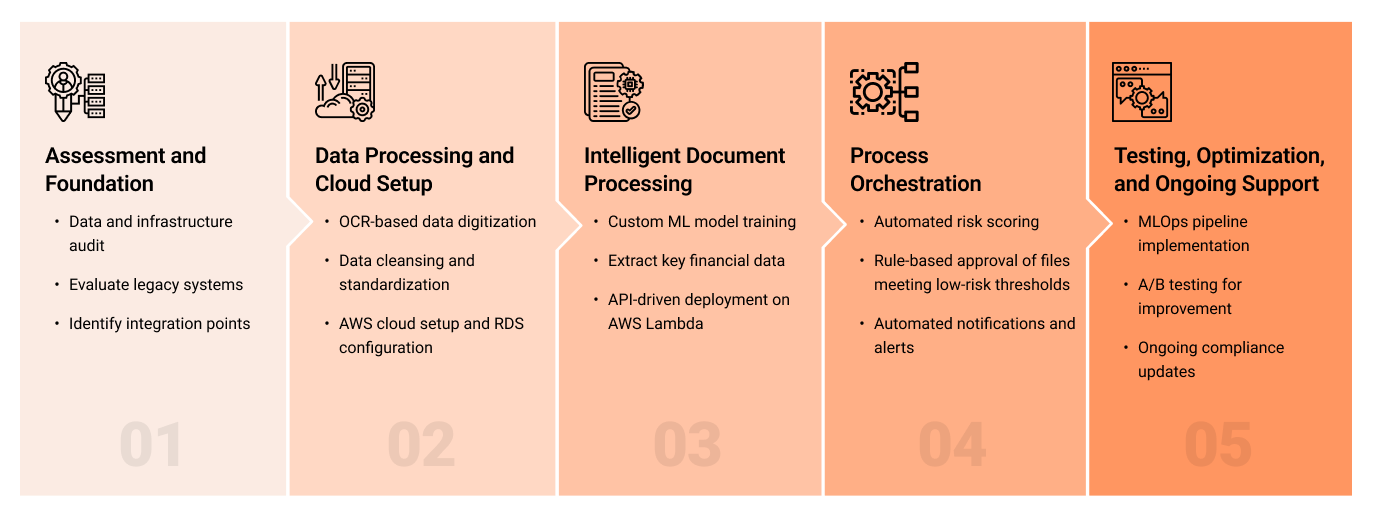

We conducted a comprehensive audit of the firm’s existing document archives, data infrastructure, and legacy systems to determine data readiness, governance needs, and integration points.

We ran several batches of documents through computer vision (OpenCV-based) OCR tools to digitize them. Our experts then applied data-cleansing rules and standardization algorithms to normalize entity formats (e.g., dates, currencies, nomenclature) across the entire archive.

This step also involved setting up an AWS environment, defining the microservices architecture, setting up VPC (virtual private cloud) security, and configuring the Amazon RDS (PostgreSQL) instance to serve as the single source of truth for this structured data.

We built a proprietary IDP module to automatically ingest, categorize, and standardize it. This module was deployed on AWS Lambda using custom APIs managed by Amazon API Gateway. This module extracted data and instantly classified it based on key attributes using custom-trained (on the client’s proprietary data) TensorFlow models.

Extracted attributes:

We then developed a process automation engine that calculated the preliminary financial risk score automatically from these insights. Loan files meeting pre-set, low-risk thresholds were immediately fast-tracked, and automated notifications were triggered to alert analysts.

We implemented an automated MLOps pipeline on SageMaker to retrain and optimize the TensorFlow models, validating accuracy at every iteration. This ensured the system consistently maintained a 99.5 percent data extraction accuracy benchmark. Our team also ran controlled A/B evaluations on new document layouts and regulatory changes to keep the model robust and compliant.

20-30% reduction in operational IT costs

35% higher underwriter throughput

60% reduction in manual effort needed for audit trail generation

90% reduced data entry rate with automation

We build production-grade workflow automation platforms that enhance efficiency, reduce manual workloads, and standardize operations across multi-site environments. Contact us to learn more about our business process automation services.