Outsource Mortgage Title Support Services

Title search is an integral part of any mortgage business or lending institution. The whole process involves a plethora of sub-tasks ranging from ordering the title, verifying the financial obligations of the borrower and property seller, property insurance to title transfer and many more. If you take care of all these tasks on your own, your efficiency as a lender takes a beating. We at SunTec India are committed to adding value to your business with our Mortgage Title Support Services.

At SunTec India, we have a team of well qualified and experienced experts to take care of all your title search needs. With their hands-on experience of the latest search tools and an eye for detail, they help mortgage companies and lenders establish the ownership of properties.

Whether it is analyzing the financial implications of a mortgage, ordering the title report, acquiring mortgage policies or transferring property rights, our experts can lend a helping hand in every process. With our tailor-made mortgage support services for lenders and credit unions, we enable them to focus on their core business.

Mortgage Title Support Services: Helping Lenders Uncover Hidden Issues

Our mortgage title search experts are adept at checking the authenticity of title documents and accurately bringing out the exceptions. With their vast experience, industry know-how and streamlined approach, they help mortgage companies, lenders and credit unions minimize their time to market. By outsourcing mortgage title support services to us, you can enhance the efficiency of your operations by up to 50%.

The Comprehensive Suite of our Mortgage Title Support Services:

Mortgage Title Examination

You as a lender need accurate insights into the history of the property you are financing. Details such as owner history, date and time of transactions, legal heirs, lawsuit history have to be accurately examined by the experts of the trade before a mortgage deal is finalized. As the lender is ultimately responsible for the security of their money, they cannot simply rely on the report of the title company. When you outsource mortgage title support services to us, we become your eyes and ears to unearth any inconsistencies in the title report.

Our title examination professionals have the skills and industry knowledge to protect lenders against property sale fraud. They meticulously check all the financial and statutory obligations associated with the property for sale. They cross-examine all the details related to the property to safeguard the interests of the lender. As part of our title examination services, we thoroughly check taxes, liens, lawsuits, legal claims, etc. and identify any issues that can potentially impact the transaction. Accuracy and speed is the hallmark of our services.

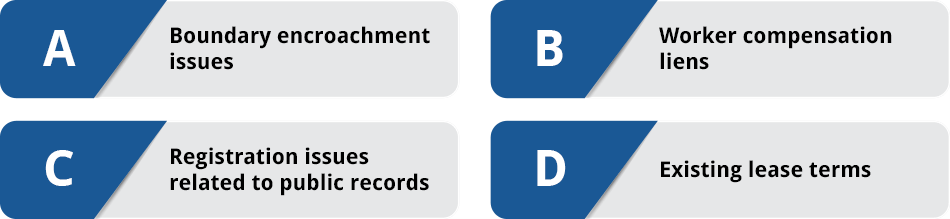

In addition to standard title examination services our mortgage title assistants also identify issues such as:

Mortgage Title Ordering

Mortgage title ordering is a time-consuming process that involves liaising with the loan officer to obtain details of the mortgage title. You have to follow up with the title company to get the report on time. Our experts are adroit at taking care of all these tasks. They work in close coordination with your in-house team to enhance the overall efficiency of your operations.

Our experienced team of mortgage title search experts is adept at handling title ordering for your organization. Whether you are a lender, credit union or a brokerage company, our seasoned professionals understand your individual needs and accordingly devise a customized solution for you. They follow the regulatory guidelines in obtaining the desired information from the loan officer and ordering the title report of the property. To augment the title reporting process, they consistently follow up with the title company. With our services at your disposal, you can get title reports within a quick turnaround time.

Mortgage Title Commitment

Mortgage title commitment is an important report that is generated by the title company once the title search is completed. The faster you get this report, the earlier you can complete the loan disbursement. Our title commitment experts obtain the title commitment report within a quick turnaround time, thanks to their hands-on experience of dealing with title companies. Our experts continually strive to clear every defect identified in the title examination process. With their in-depth understanding of the mortgage business and the use of technology, they expedite your title commitment process.

We make sure that every detail of the property is duly reviewed well before the deal is closed. The aim of our title commitment services is to help you maintain good customer relationships and reputation in the market. Our title support services for lenders not only give you a 360-degree view of the property in question but also enable you to interpret the title report in the right perspective.

Mortgage Title Insurance

Title insurance is a rather intricate process that eats into the productive time of lending institutions and mortgage companies. The team at SunTec India leverages its industry knowledge and technical efficiency to augment your operations and customer experience. We do understand that your interests as a lender are different from that of a buyer when it comes to insurance of the property. To ensure that your interests are well protected, our specialized team takes care of every aspect of lender title insurance.

As part of our mortgage title insurance services, we:

- Help mortgage companies and lenders in ordering insurance for the property

- Thoroughly examine and review the insurance document for any existing liens and exceptions

- Identify and highlight inconsistencies in the title insurance document

Advantage of Outsourcing Mortgage Title Services to SunTec India

Being a specialized provider of mortgage solutions, SunTec India has developed the capability to enhance the operational agility of lenders and mortgage companies. Our experts take time to understand your individual needs and accordingly devise a customized solution for you. Our mortgage experts work in close coordination with your in-house team to deliver excellent results within a quick turnaround time. Our services not only enhance the efficiency of your business operations but also keep you ahead of your competitors.

Benefits of Partnering with SunTec India for Mortgage Title Support Services

- Easy access to the most suitable skill sets

- In-depth understanding of the mortgage industry

- Proven track record of serving lenders, mortgage companies and credit unions

- ISO 9001 and 27001 certification for superior quality and data security

- Flexible and scalable outsourcing models to suit your individual needs

- 24X7 customer support for instant resolutions of issues and queries

Outsource Mortgage Title Support Services to SunTec India

Our real estate experts and data professionals resolve mortgage title complexities- from title ordering and inspection to examination -so you can operate stress-free.

To outsource mortgage title support services to the SunTec India team, send your requirements to info@suntecindia.com. Also, if you have any other queries related to our services or need a free demo to understand how we work, reach us via email or fill the form.

CEO of a leading firm in US