Hybrid Invoice Data Validation for AP Solutions

With over three decades in the market, this firm is a leading provider of international trade system solutions. Their fully customizable, off-the-shelf software helps businesses, such as freight forwarders, shipping agents, airline cargo sales agents, and customs brokers, streamline workflows, maintain regulatory compliance, and optimize end-to-end global trade operations.

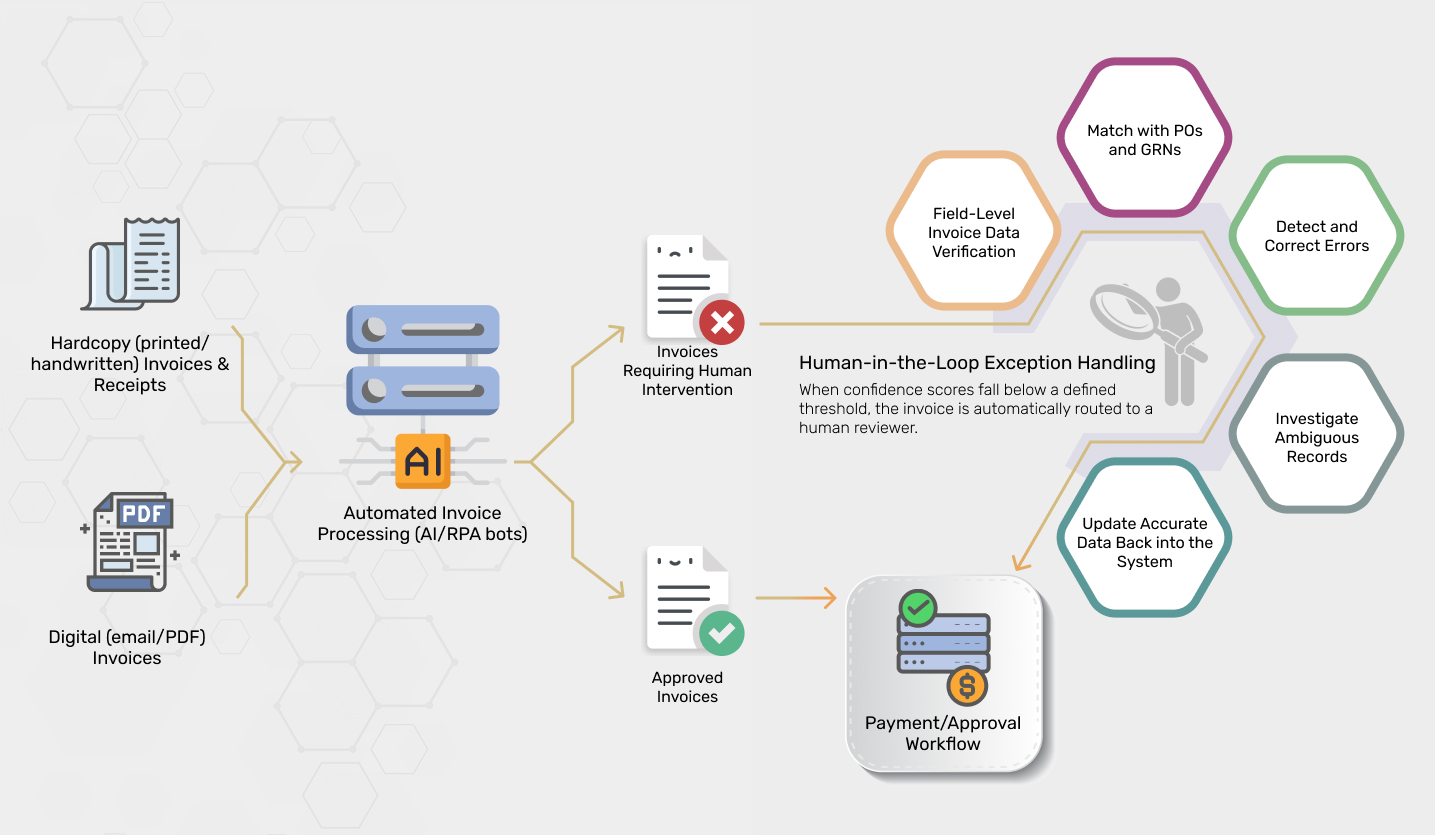

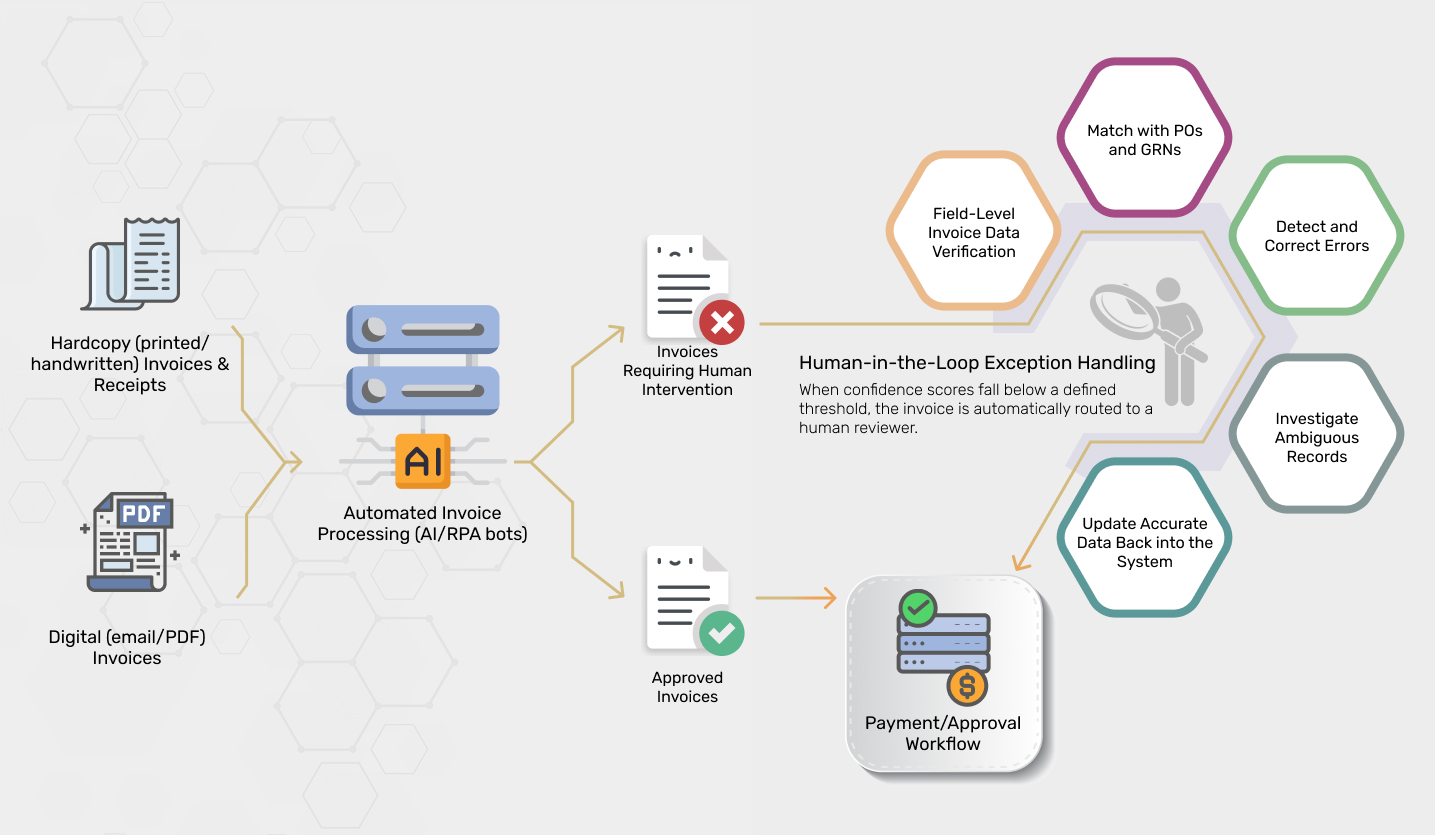

The client required a dedicated invoice processing service provider for their centralized, automated accounts payable (AP) system.

Every month, the system records thousands of invoices from multiple clients, each following distinct data formats and submission protocols. While the client’s proprietary AP platform automatically processed those bills, it generated a significant volume of exceptions due to varying data formats, incomplete fields, and submission errors. These records tie directly to financial transactions and compliance with trade regulations, so mistakes led to financial losses or legal issues.

Hence, the key project requirements included:

While the AP system automated invoice intake, it frequently generated exceptions that required manual intervention due to several recurring issues:

To manage high invoice volumes without disruption, we implemented a flexible staffing solution: five full-time specialists dedicated to invoice processing, supported by four part-time resources during seasonal surges. The team worked in rotational shifts for 6 days a week to ensure zero downtime.

Our invoice processing and data management support covered:

Every invoice flagged by the AP system was reviewed and corrected according to template-specific SOPs. This allowed the team to handle diverse invoice formats without disrupting turnaround times.

Poorly scanned invoices or handwritten fields were reviewed manually. A double-key entry method was used for high-risk fields, with mismatches escalated to senior reviewers to confirm accuracy.

Regional language and trade terms were interpreted by trained associates and standardized into English equivalents. Over time, a reference glossary was developed for recurring terms to maintain consistency.

A dedicated project manager supervised both day and night shifts, overseeing workflows and conducting final quality audits before submission to the client. This minimized errors and ensured every record met the client’s standards.

Critical data fields such as totals, currency codes, and tax amounts were cross-checked against client master data and reference sources to prevent compliance or financial reporting errors.

During peak cycles—such as national holidays or month-end deadlines—the team provided overtime support and deployed additional part-time associates to prevent backlogs and ensure deadlines were met.

All work was performed exclusively on the client-hosted AP system under ISO 27001-certified protocols. VPN-secured connections, multi-factor authentication, and real-time monitoring safeguarded sensitive financial and trade data.

Operating entirely in the client-hosted environment meant robust data security was critical. To protect sensitive business documents and ensure confidentiality, we enforced the following measures:

Our human-in-the-loop approach, scalable workflows, and global time zone adaptability have proven useful in delivering this invoice processing project on time. The measurable success of this collaboration led the client to enter into a long-term, three-year engagement, designating us as their strategic partner for financial data processing services.

With zero downtime, ensuring uninterrupted operations.

Eliminating billing disputes and simplifying financial reconciliations.

Accelerated turnaround times leading to quicker payment cycles.

Significant operational savings with on-demand resource alignment.

With a human-in-the-loop financial data validation approach, we guarantee data accuracy and security in your accounts payable operations.